The End of Prudence

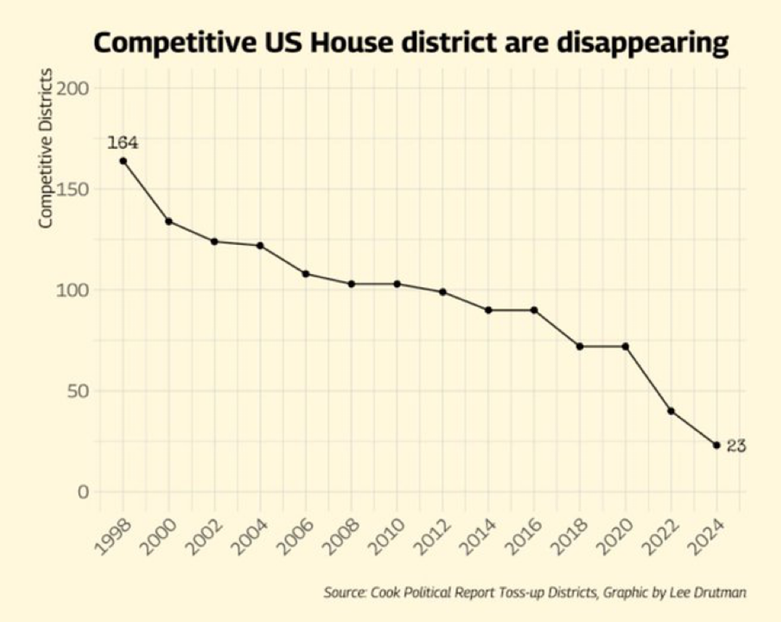

In their most recent Budget and Economic Outlook, the CBO wrote, “The deficit totals $1.6 trillion in fiscal year 2024, grows to $1.8 trillion in 2025, and then returns to $1.6 trillion by 2027. Thereafter, deficits steadily mount, reaching $2.6 trillion in 2034.” Last year, when two ratings agencies downgraded their views for US debt, they both pointed to the same problem: Congress. Below is a chart from the venerable Cook Political Report that tells us why Congress has become a long-term threat to our economic well-being.

The chart illustrates that over the past 26 years, of the 435 seats in The House of Representatives, we have seen the number of districts considered a “Toss-up” fall from 164 to 23. The number of districts considered likely to be competitive is only slightly higher at 42. That means that more the 90% of House races are entirely non-competitive or unlikely to be competitive.

There are two main reasons for this phenomenon. The first is that our society has become politically bifurcated where rural areas tend to be overwhelmingly “red” while urban and suburban areas tend to be “blue”. The second is gerrymandering or the practice of state legislatures, with state court approval, drawing the district lines in such a way that the number of districts is maximized for the majority. This is done across the country in both Democratic and Republican dominated states. There is no moral high ground being staked out by either party on this one.

We are now left with a Congress dominated by people who are far more worried about losing their seat to someone with more extreme views in their primary than in the general election. There is no longer room for compromise and worse yet, the extreme flanks of both undercut the efforts of their more moderate colleagues to pass virtually anything. The result is that the hard stuff, the prudent stuff, never gets done. Raising revenues and cutting spending are always hard.

Deficits are rarely ever the “fire closest to the barn”. To the contrary, it’s kind of nice to spend far more than you collect in taxes. Look at our current economy plodding ahead despite the historic monetary policy tightening. While there are other factors at play, the fiscal stimulus is a major offset to the Fed’s efforts. The problem is that if Congress doesn’t address our unsustainable fiscal path, markets will.

The kind of deficits we are currently running have only happened in either times of war or recession. Not only are we not in a recession, but the unemployment rate is at a level that in previous decades was associated with something closer to a balanced budget. It is unprecedented (for good reason) that we have never run deficits as a percentage of GDP this high when we were anywhere close to full employment. What if we do end up in a recession? We would face a situation of further soaring deficits due to falling tax revenues. Additionally, our current level of deficits would preclude any kind of fiscal stimulus to help get us out of that recession.

The longer-term issue is that in a globally higher inflation and rate environment, in a world where even Japan is raising rates, servicing the debt overwhelms budget outlays as we already now spend more on interest costs than national defense.

We are lucky. The US is special. The dollar is the global reserve currency, and the US Bills are the global risk-free asset. That isn’t likely to change anytime soon. However, that doesn’t mean that Congress can run deficits equivalent to 6-8% of GDP in perpetuity without repercussions in the form of higher long-end interest rates. I know there has been handwringing about reckless Congressional spending for decades. But for all those years, amid “The Great Moderation” of inflation, rates were falling and therefore the cost of carry declined. That is no longer the case. We now face increased inflation volatility in the US and globally. That means higher rates and that means that big, embedded deficits start to matter in a big way.

Tim Pierotti is WealthVest’s Chief Investment Officer.

Tim has over 25 years of experience in various aspects of the equities business. Prior to joining WealthVest, Mr. Pierotti spent seven years in Equity Research management roles at Deutsche Bank and most recently at BMO where he was a Managing Director and Head of US Product Management. Tim has 11 years of investment experience most notably as Head of Consumer Research and Portfolio Manager at The Galleon Group, a former NY based $8Bln Long/Short hedge fund. Tim is a graduate of Boston College and lives in Summit NJ.

WealthVest makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made in this material, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of Tim as of the date indicated. They do not necessarily reflect the views and opinions of WealthVest and are subject to change at any time without notice. WealthVest does not have any responsibility to update this material to account for such changes. There can be no assurance that any trends discussed during this material will continue.

Statements made in this material are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed in this material, including consulting their tax, legal, accounting or other advisors about such information. WealthVest does not act for you and is not responsible for providing you with the protections afforded to its clients. This material does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by WealthVest.

Certain statements made in this material may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The S&P 500® is a trademark of Standard & Poor’s Financial Services, LLC and its affiliates and for certain fixed index annuity contracts is licensed for use by the insurance company producer, and the related products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC or their affiliates, none of which make any representation regarding the advisability of purchasing such a product. WealthVest is not affiliated with, nor does it have a direct business relationship with Standard & Poors Financial Services, LLC.