What is your inflation hedge?

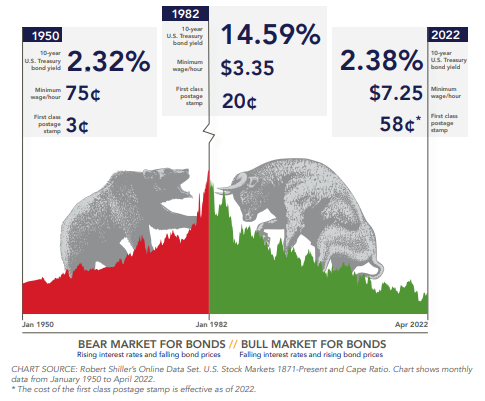

Inflation is a hidden danger in retirement. Considering retirement can last 30-40 years, increasing medical costs, food costs, housing costs and transportation costs can leave retirees far poorer if their savings do not keep pace with inflation. Many retirees depend upon fixed-income investments such as bonds and bond funds during retirement, which are not designed to keep up with inflation as these investments provide fixed coupon payments. The Federal Reserve typically combats high inflationary periods by raising the federal funds rate to ease an overheated economy. Changes in interest rates are one of the most significant factors affecting bond values in the secondary market. A truth of bond and bond fund investing is that when interest rates rise, secondary bond market prices fall. This chart shows both inflation examples and bond yields since 1950, with rising bond yields – a bear market for bonds and falling bond yields – bull market for bonds.

Why should you insulate your fixed portfolio?

If you hold a bond to maturity, you can expect to receive your initial principal, unless the company defaults. If you sell a bond before maturity in a rising interest rate environment, the price you will receive is typically less than your initial investment.* FINRA issued an investor alert giving the following example “…a bond fund with 10-year duration will decrease in value by 10% interest rates rise by 1%”

How can you insulate your portfolio?

One option exists in a Fixed Index Annuity. A fixed index annuity (FIA) is a tax-deferred, long-term retirement savings vehicle issued by an insurance company. FIAs are designed to meet long-term needs for retirement income. While product and feature availability may vary by insurance carrier and state, in general, FIAs provide guarantees of premiums (backed by the financial strength and claims-paying ability of the issuing company), credited interest (subject to surrender charges), and a death benefit for beneficiaries. Any distributions may be subject to ordinary income taxes and if taken prior to age 591/2, an additional 10% federal tax. Early withdrawals may result in loss of the premium and credited interest due to surrender charges. Fixed index annuities do not have a memory past one year, so interest credits are locked in during market declines. This allows the fixed index annuity contract value to remain level during declines at the next annual point to point interest crediting date.

How can FIAs protect investors from inflation?

First, interest is credited to the account value of a FIA based on market index gains, and when looking back over the last 22 years, the FIA has outpaced the Consumer Price Index by $34,338 in our previous example. The performance and protection of an FIA can be an attractive alternative to traditional fixed income products, such as CDs or bond funds. This means that an investor can have a principal-protected investment, keeping his or her money safe, and outpace inflation.

Second, FIAs can protect investors from inflation by providing a supplemental guaranteed-for-life income stream. Often, this is a feature of an FIA’s lifetime income rider. These riders typically contain an additional fee that is taken from the account value. This income stream is contractually guaranteed for the duration of the annuitant’s lifetime, and in the event, there is still money in the account value, it avoids probate and is transferred to the beneficiaries.

Download our new sales tool What is your inflation hedge? Here

If you have any questions about this piece or FIAs in general please reach out to your wholesaler. If you dont know your wholesaler feel free to fill out the form here.

This is not a comprehensive overview of all the relevant features and benefits of fixed index annuities. Before making a decision to purchase a particular product be sure to review all of the material details about the product and discuss the suitability of the product for your financial planning purposes with a qualified financial professional. The annual reset allows for any interest credited on each contract anniversary to be “locked-in” and it can never be taken away due to market decreases. The interest credited is added to the accumulation value of your contract, which then becomes the guaranteed Accumulation Value “floor” that will be included in the calculation of the interest that is credited going forward, subject to any withdrawals and applicable rider fees. The annual reset sets the index starting point each year at the contract anniversary. This reset feature is beneficial when the index experiences a severe downturn during any given year because not only do you not lose accumulation value from the downturn, but the new starting point for future growth calculations is the lower index value. Although an external index may affect your interest credited, the contract does not directly participate in any equity investments. You are not buying shares in an index. The index value does not include the dividends paid on the equity investments underlying any equity index. These dividends are not reflected in the interest credited to your contract. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not apply to the performance of the index, which will fluctuate with market conditions. Annuities are designed to meet long-term needs of retirement income. Annuity contracts typically require money being left in the annuity for a specified period of time, usually referred to as the surrender charge period. If you fully surrender your annuity contract at any time, guaranteed payments provided for in the contract and/or any rider will typically no longer be in force, and you will receive your contract’s cash surrender value. Before purchasing an annuity, read and understand the disclosure document for the early withdrawal charge schedule. The purchase of an annuity is an important financial decision. Talk to your financial professional to learn more about the risks and benefits of annuities.

• Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government agency or NCUA/NCUSIF