Guesstimating

On July 20th, the CBO published, “The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget”. How bad will our deficits and national debt get? We have no idea.

The Myth of the Deficit Myth

Stephanie Kelton's book, The Deficit Myth, challenges the belief that deficits matter, arguing that as a sovereign nation, we will never run out of money. However, the current state of the US economy, with low potential GDP and tight labor markets, suggests that deficits do matter, and measures need to be taken to reduce them and balance monetary policy.

Protectionism is Back

20% of GDP growth in Q1’23 came from manufacturing construction, a subsector of the economy that normally accounts for only 1% of GDP. But there will be negative unintended consequences to so much government directed investment in the long-term.

Victory Laps at Halftime

While few economists have gotten it right this year, but the sheer randomness of 2023 may have many celebrating prematurely.

Thinking Out Loud On Housing

Tim explores whether house prices will revert to the mean or if prices are likely to remain at a high-water mark for an extended period of time.

Let’s Hope Cathie is Right

Last week Tim was one of two keynote speakers at a financial services conference along with Cathie Wood, CEO of ARK Invest. Cathie, a notable investor in disruptive tech, has said “AI is going to produce the most massive productivity increase in history. The productivity gains are going to be astounding and shocking.” Tim discusses the importance of productivity gains if the US is going to be able to manage the current debt and deficit challenges.

Compelling Economic Data for Every Bias

Looking at many economic data points can reinforce individual biases whether you are a bull or a bear. Tim makes the point that money and ego are powerful forces that can overwhelm calculated decision making.

Thoughts on The Debt Ceiling, Central Bank Balance Sheets, and Housing in 400 Words (or so)

This week Tim shares his thoughts on the Debt Ceiling, Central Bank Balance Sheets, and Housing.

The Fed, Payrolls, Regional Banks and Q1 Earnings in 400 words

What can we glean from Fed hikes, regional bank woes, and Q1 earnings.

What did we learn this week? (04/28/2023)-Sometimes History Doesn't Even Rhyme

There is a mountain of evidence suggesting a recession is near, but this cycle has been characterized by some supportive dynamics that are unique from previous cycles.

Tim Pierotti’s Quarter 2 Insights

In this video, Tim discusses what to expect during quarter 2 2023, and the factors stressing today’s economy.

What did we learn this week? (04/20/2023/)-Humility

What Wall Street sell-side analysts expected to happen over the past 2 years and what happened are dramatically different. When will negative earnings revisions matter?

Liquidity and Wages

I thought I would share the two charts that I think are most important to what is going on with equity markets and with the Fed. The top chart shows the correlation of the S&P and the Fed balance sheet. As I wrote last week, the markets love a bailout. The economy has clearly slowed through the first quarter. Credit availability is sharply contracting and earnings estimates for the S&P in Q1 are expected to decline by 7% y/y. So why are risk assets rallying? I think this chart tells you all you need to know. I would also add that when so many macro investors (Hedge Funds) are positioned short, that creates a bid under the market as those entities have to cover their short positions to manage risk as the market rises.

What Did We Learn This Week? (04/11/2023) - Foreboding Credit Data

Tim explores the question: Is bad economic data good for the stock market?

Quick Thoughts on OPEC, ISM’s, GDP and Liquidity in 400 Words

Goldman’s Head of Commodity Research said yesterday, “OPEC’s pricing power is the highest it’s ever been.” The Saudi’s want oil in the $90 to $100 range. They see demand weakening globally, so they cut production. Importantly, they aren’t worried about losing global market share because US shale production is no longer the threat it had been due to shale’s declining productivity and declining rate of resource investment.

The China demand recovery hasn’t materialized like the oil bulls hoped. Makes sense given the property sector is already overbuilt and and the Chinese export economy isn’t getting any help from slackening European and the US demand.

Don’t Borrow Trouble

We have plenty of things to worry about in the US economy with the cost of debt going up and its availability going down, but European bank CoCo’s probably isn’t one of them.

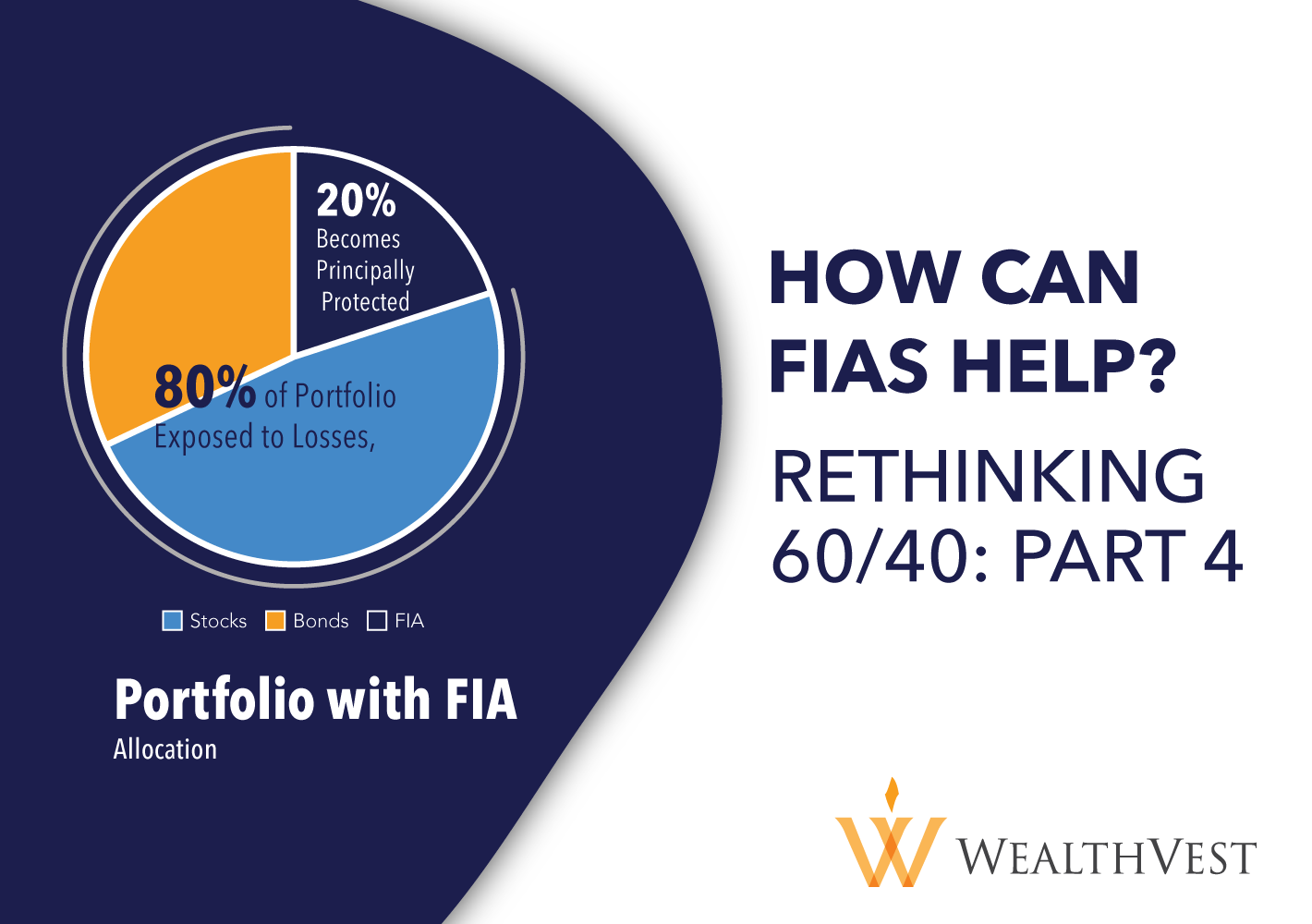

Rethinking 60/40 Part 4: How Fixed Index Annuities Can Help

WealthVest believes that there is a natural fit for FIAs within optimized portfolios A fixed index annuity is a type of fixed annuity that offers a rate of return based on market performance. An FIA is appropriate for someone who is closer to retirement, prefers tax deferral, principal protection, and market participation. While FIAs may not be appropriate for younger individuals with higher risk tolerance or if they need access to their funds immediately. By allocating 20% of a 60/40 portfolio to an FIA, the portfolio’s risk premium decreases due to the guaranteed protection from the annuity.

What Did We Learn This Week? (03/17/2023) - STILL

Whenever you hear someone talking about the economy and they use the word “still”, your ears should perk up

What Did We Learn This Week? (03/07/2023) - The Godot Recession

Why hasn’t the “most anticipated recession in history” started yet?

Rethinking 60/40 Part 3: How Multi-Year Guaranteed Annuities Can Help

WealthVest believes that there is a natural fit for MYGAs within optimized portfolios. A multi-year guaranteed annuity, or MYGA, is a type of fixed annuity that offers a guaranteed fixed interest rate for a certain period, usually from three to ten years. A MYGA is appropriate for someone who is closer to retirement and prefers tax deferral and a guarantee of investment return. By allocating 20% of a 60/40 portfolio to a MYGA, the portfolio’s risk premium decreases thanks to the guaranteed protection from the annuity.