Lesson One: How Tax Defferal Can Impact Returns

Are you currently moving money into CDs? How much impact do you think taxes have on these returns? In this lesson we discuss how taxes can have an impact on any investment and, alternatives that would allow for tax-deferred growth.

Lesson Two: When Your Clients' Have Volatility and Uncertainty on Their Mind

How can you help your clients eliminate poor investment choices and safely take out more during retirement? The first case study in our Longevity Paradox series – covers how investor behavior is a major source of under-performance and how life expectancy and the changing demographics of the United States is affecting the retirement landscape. Watch the following video to learn how to have these discussions with your clients:

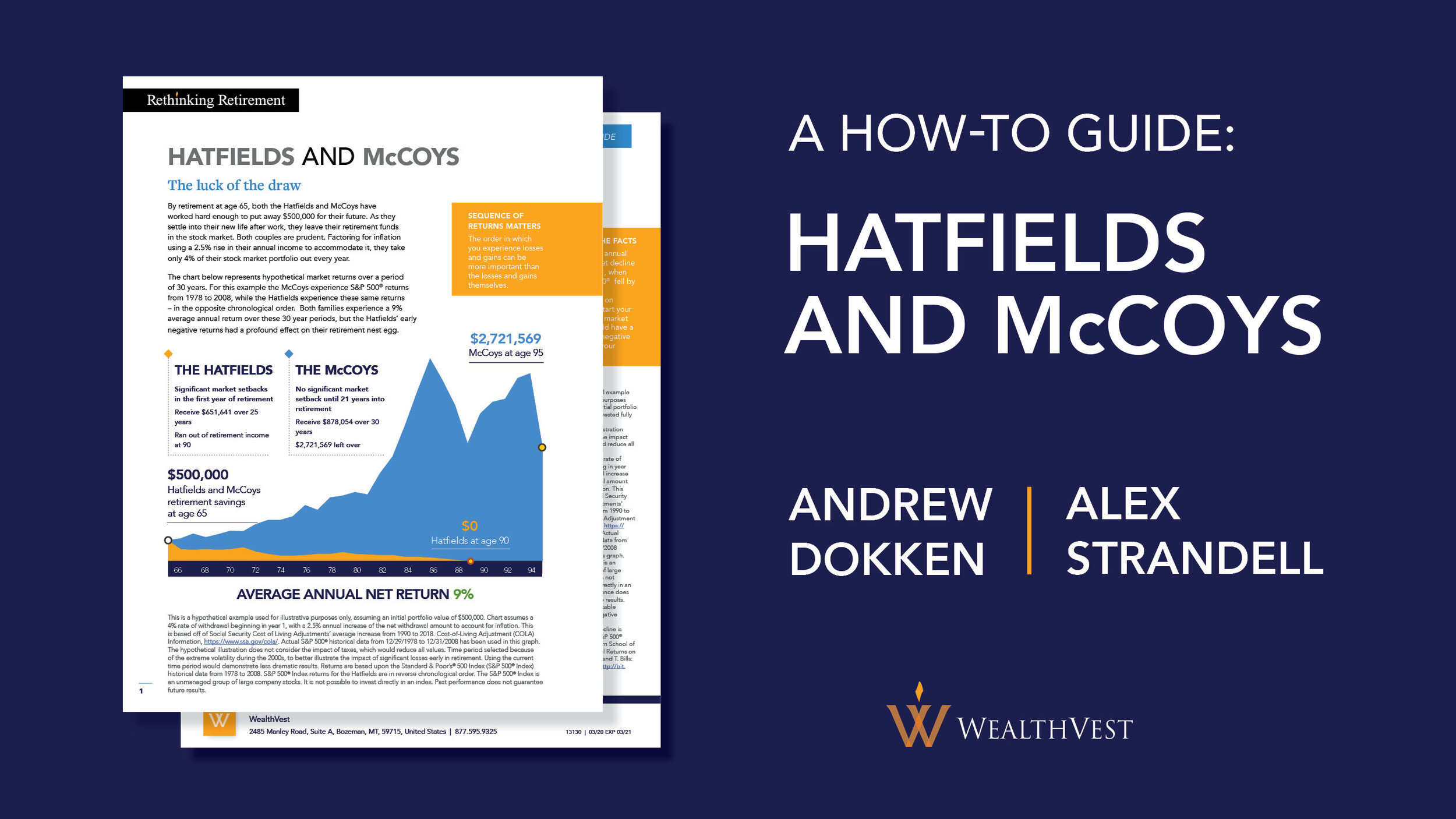

Lesson Three: The Sequence of Return Risk in Retirement

A 9% average annual return means a comfortable retirement right?

Think again. The sequence of these returns can be critically important. A large early loss can change everything. This two-page resource will help you to teach clients about the sequence of return risk facing American retirees.

Lesson Four: A Strategy for Every Market

Looking for gains in today's volatile market? Watch the video below to explore a resource you can use with your clients to help create positive growth in their contract value year over year regardless of what the market is doing.

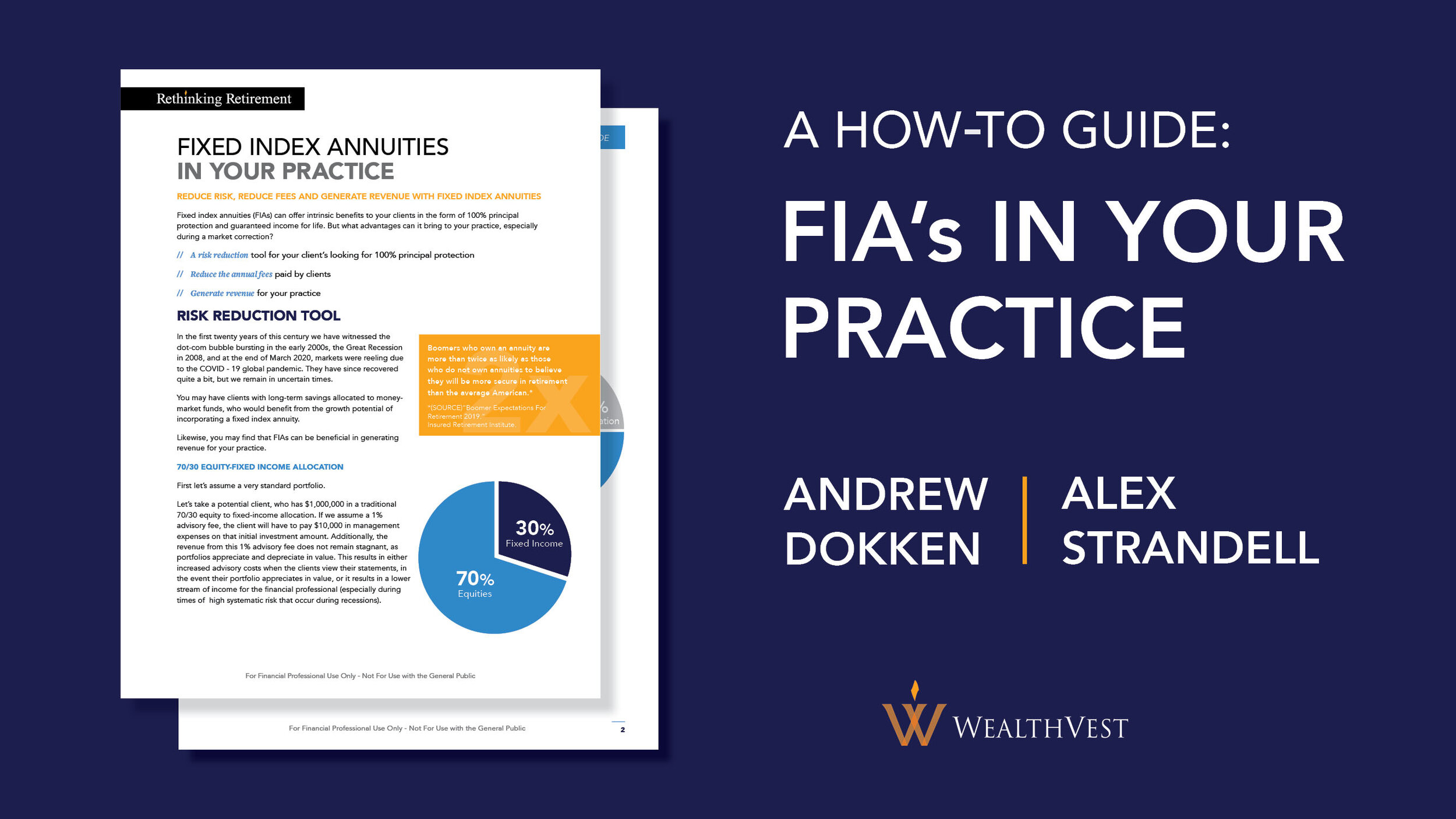

Lesson Five: How can you supplement your revenue and protect your clients?

What types of questions are your clients asking you about today? Chances are they are looking for safety and security in the midst of a global pandemic. Have you asked the same question for your own business? We may have a solution for both of these needs.

Learn why financial professionals like yourself are turning to this innovative solution.

Lesson Six: How much money are your clients leaving on the table?

Today, individuals may be waiting to move their money into longer duration bonds and investments until the interest rate environment improves. How much does this really cost them?

This video demonstrates this cost and shows how they can receive more today without having to wait.