HOW YOU CAN HELP YOUR CLIENTS IN THIS BEAR MARKET

How detrimental were past bear markets?

You are undoubtedly getting phone calls each and every day from your weary and worried clients about what they should be doing with their investments and how today’s events will affect their financial plan. You’ve helped navigate them through the ups and downs of the market in the past, but this is the first time guiding them through a worldwide pandemic. What do you tell them?

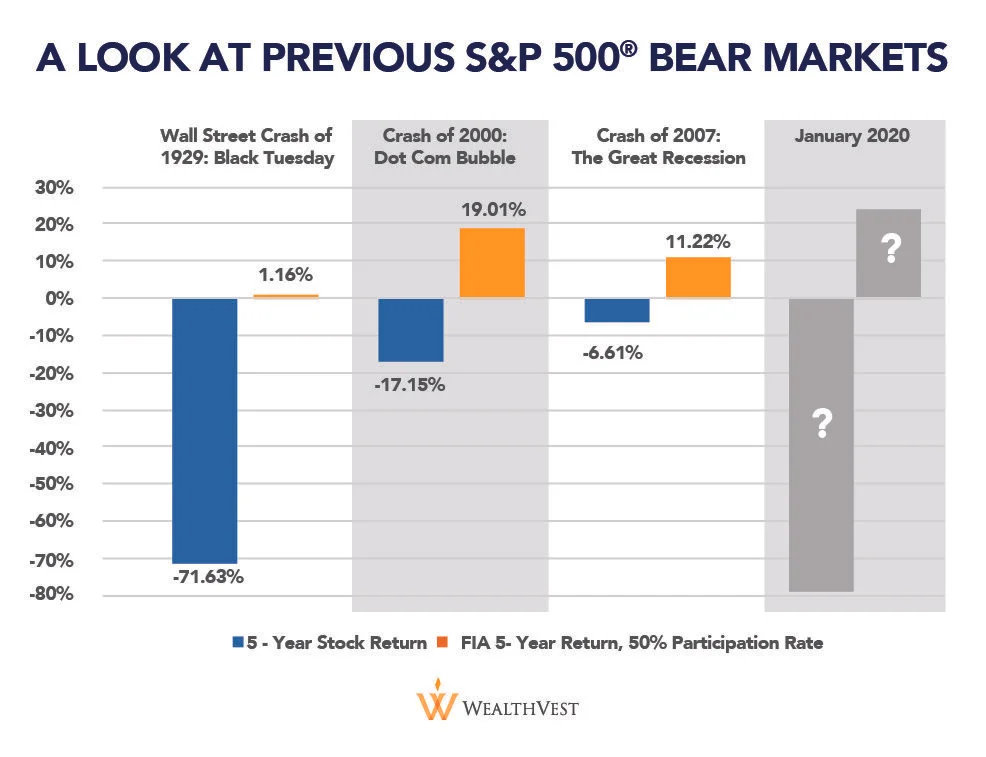

PAST BEAR MARKETS

While staying the course may be a great strategy for some clients, the market can still fall further, and possibly set clients back years in their retirement. What amount of risk are your clients willing to take in these tumultuous times? There are options to help take the risk out of the market that provide clients with piece of mind through principal protection. The time to buy principal protection is now. One option to talk to your clients about principal protection is a Fixed Index Annuity or FIA. If the market does go up, your client receives a portion of the gains at the end of the contract year based off the crediting method selected, if it goes down the contract value remains steady and takes no market losses. Any future gains are now locked in at this level and the returns are calculated from the new contract date moving forward, resetting annually. This is the right time to discuss principal protection and upside participation with your clients.

HOW FIXED INDEX ANNUITIES PERFORM THIS CENTURY

Begin the conversation on principal protection by utilizing our consumer facing sales tool Do you have bear market insurance? We set the stage on how detrimental bear markets were in the past to advisory accounts, and how a hypothetical FIA would have performed through these massive bear markets (Black Tuesday, The Dot-Com Bubble, and The Great Recession). The second page helps easily explain the power of annual reset and principal protection. Focus on the locks, as they represent sharp downturns in the S&P 500®. The locks matter today, because in these instances, the contract value in the hypothetical FIA returned 0% and thanks to their feature of principal protection, while the market experienced negative returns. The following rally’s gains were captured up to a participation rate. In 2008, the S&P 500® experienced a 38.14% loss while the FIA with a 40% annual point-to-point Participation Rate in the S&P 500® would have returned 0%. When the market rebounded by 25.32% in 2009, the FIA, which started at pre-crash 2008 levels, would have returned 9.38%. Between 2008 and 2009, the S&P 500® advisory account experienced a loss of -22.47%, while the FIA with a 40% Participation Rate in the S&P 500®, returned 9.38% over the same period. Start conversations around the concept of principal protection in order to protect your client’s retirement savings during this bear market.

Download the sales tool; Do you have market insurance? Here

For more consumer-approved resources click here

When you buy a fixed index annuity, you own an insurance contract. You are not buying shares of any stock or index. This is not a comprehensive overview of all the relevant features and benefits of fixed index annuities. Before making a decision to purchase a particular product be sure to review all of the material details about the product and discuss the suitability of the product for your financial planning purposes with a qualified financial professional.

The annual reset allows for any interest credited on each contract anniversary to be “locked-in” and it can never be taken away due to market decreases. The interest credited is added to the accumulation value of your contract, which then becomes the guaranteed Accumulation Value “floor” that will be included in the calculation of the interest that is credited going forward, subject to any withdrawals and applicable rider fees.

The annual reset sets the index starting point each year at the contract anniversary. This reset feature is beneficial when the index experiences a severe downturn during any given year because not only do you not lose accumulation value from the downturn, but the new starting point for future growth calculations is the lower index value.

Although an external index may affect your interest credited, the contract does not directly participate in any equity investments. You are not buying shares in an index. The index value does not include the dividends paid on the equity investments underlying any equity index. These dividends are not reflected in the interest credited to your contract.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not apply to the performance of the index, which will fluctuate with market conditions. Annuities are designed to meet long-term needs of retirement income. Annuity contracts typically require money being left in the annuity for a specified period of time, usually referred to as the surrender charge period. If you fully surrender your annuity contract at any time, guaranteed payments provided for in the contract and/or any rider will typically no longer be in force, and you will receive your contract’s cash surrender value. Before purchasing an annuity, read and understand the disclosure document for the early withdrawal charge schedule. The purchase of an annuity is an important financial decision. Talk to your financial professional to learn more about the risks and benefits of annuities.

Please note that in order to provide a recommendation to a client about the liquidation of a securities product, including those within an IRA, 401(k), or other retirement plan, to purchase a fixed or variable annuity or for other similar purposes, you must hold the proper securities registration and be currently affiliated with a broker/ dealer or registered investment advisor. If you are unsure whether or not the information you are providing to a client represents general guidance or a specific recommendation to liquidate a security, please contact the individual state securities department in the states in which you conduct business

KEY TERM FIXED INDEX ANNUITY (FIA):

A fixed index annuity (FIA) is a tax-deferred, long-term retirement savings vehicle issued by an insurance company. FIAs are designed to meet long-term needs for retirement income. While product and feature availability may vary by insurance carrier and state, in general, FIAs provide guarantees of premiums (backed by the financial strength and claims-paying ability of the issuing company), credited interest (subject to surrender charges), and a death benefit for beneficiaries. Any distributions may be subject to ordinary income taxes and if taken prior to age 591/2, an additional 10% federal tax. Early withdrawals may result in loss of the premium and credited interest due to surrender charges.

Chart Source

“11 Historic Bear Markets,” NBC News, accessed February 5, 2020 <http://www.nbcnews.com/id/37740147/ns/ businessstocks_and_economy/t/historic-bear-markets/#.WMmCbFUrJhE>.

See: Drew Dokken and Wade Dokken, “A Client’s Perspective on Best Interest”, for information on how these returns are calculated <https://wealthvest.com/white-papers>.

Robert Shiller, “Online Data - Robert Shiller.” Online Data - Robert Shiller, accessed February 5, 2020, <http://www.econ.yale. edu/~shiller/data.htm>.

C1000 03/24/2020