Consumer Price Index: A History

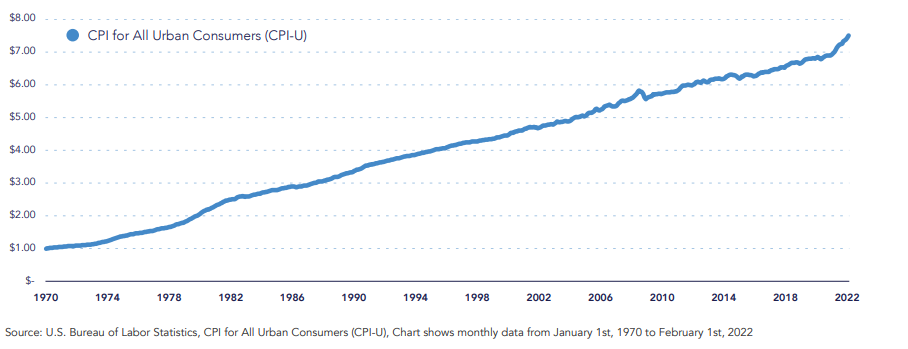

Since 1970, the cumulative rate of inflation has been 651%. The chart below shows what $1 in 1970 would be worth today, if it kept pace with inflation, meaning todays dollar would be worth 13 cents back in 1970.

This chart shows the growth of $1 from 1970 to 2022 if it had kept up with inflation.

In more recent history, since 2000 inflation has grown 68.08%, meaning that if a retiree in December 1999 was living off of an income of $100,000, he or she would have needed to grow his or her retirement income to $168,078 by February of 2022 to have the same purchasing power.

Inflation is the hidden danger in retirement. Considering retirement can last 30-40 years, increasing medical costs, food costs, housing costs and transportation costs can leave retirees far poorer if their savings do not keep up with inflation. Many retirees depend upon fixed-income investments during retirement, which are not designed to keep up with inflation. Social Security has cost-of-living adjustments, but sometimes it can be prudent to supplement this income. It is important to look at where inflation has been and where it may be headed to build a retirement income plan that factors in inflation risk.

To download this consumer approved tool to use with your clients click here