Rethinking 60/40 Part 4: How Fixed Index Annuities Can Help

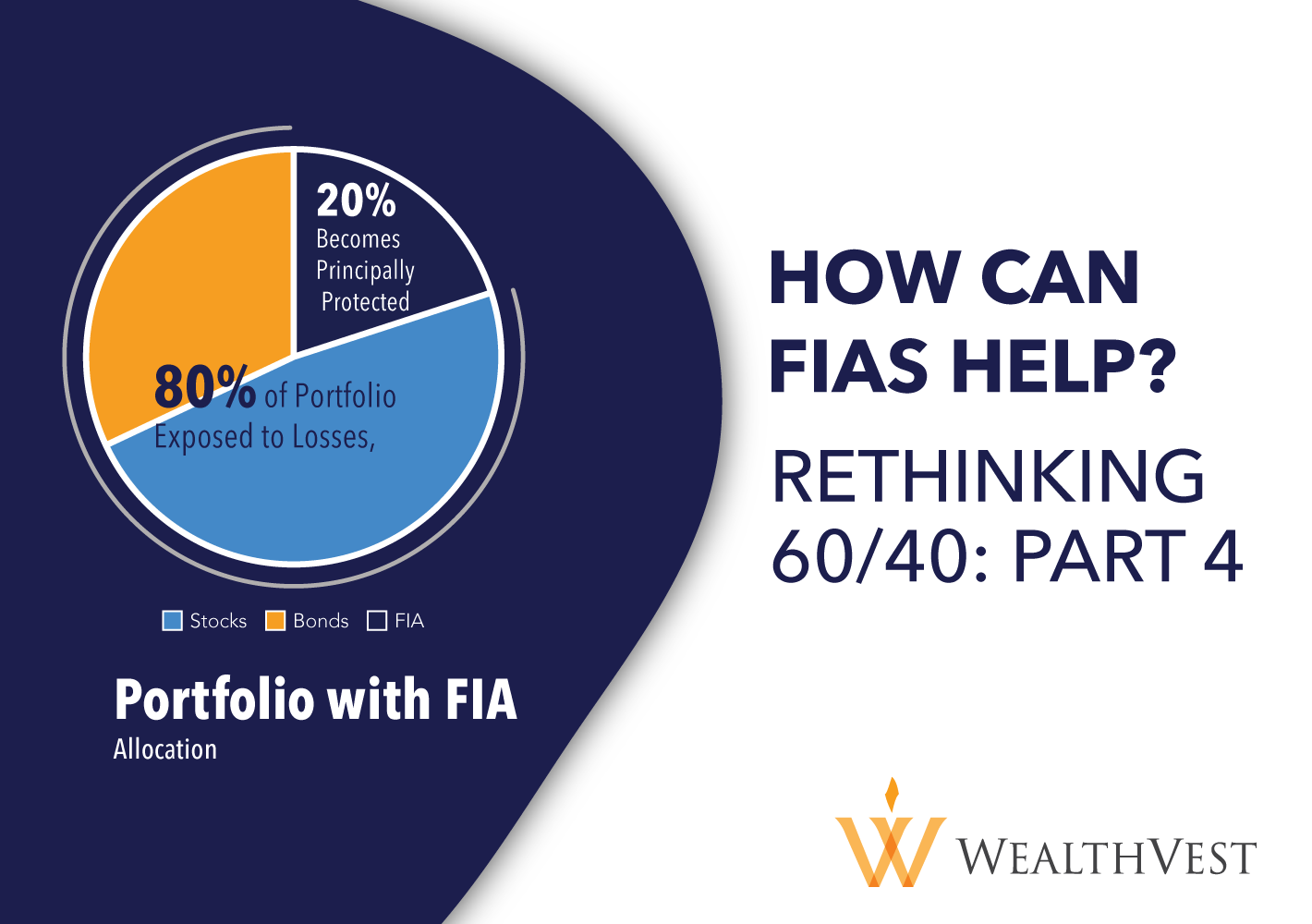

WealthVest believes that there is a natural fit for FIAs within optimized portfolios A fixed index annuity is a type of fixed annuity that offers a rate of return based on market performance. An FIA is appropriate for someone who is closer to retirement, prefers tax deferral, principal protection, and market participation. While FIAs may not be appropriate for younger individuals with higher risk tolerance or if they need access to their funds immediately. By allocating 20% of a 60/40 portfolio to an FIA, the portfolio’s risk premium decreases due to the guaranteed protection from the annuity.

Rethinking 60/40 Part 3: How Multi-Year Guaranteed Annuities Can Help

WealthVest believes that there is a natural fit for MYGAs within optimized portfolios. A multi-year guaranteed annuity, or MYGA, is a type of fixed annuity that offers a guaranteed fixed interest rate for a certain period, usually from three to ten years. A MYGA is appropriate for someone who is closer to retirement and prefers tax deferral and a guarantee of investment return. By allocating 20% of a 60/40 portfolio to a MYGA, the portfolio’s risk premium decreases thanks to the guaranteed protection from the annuity.

Rethinking 60/40 Part 2: What can we learn about the years when stocks and bonds are both negative?

Rethinking 60/40: What can we learn about the years when stocks and bonds are both negative?

In our last blog post, I discussed the underlying reasons for today’s underperformance of 60/40 portfolios, but let’s look at how much of an anomaly today’s times are and where 2022 falls in history. Since 1928, we can glean the underlying reasons a 60/40 portfolio allocation became popular method for investors seeking reliable returns. The chart below shows historical corporate bond yield and the S&P 500® returns by year, demonstrating how often bonds and stocks remained positive. However, looking at the years in which equities and bonds are negative provides important context for the contemporary market environment.

Rethinking 60/40: Part 1-Why investors use 60/40 allocations?

Rethinking 60/40: Why have individuals used 60/40 Allocations for their Retirement Savings?

A portfolio invested in 60% stocks and 40% bonds, commonly known as a 60/40 portfolio, is where many portfolios start before adjusting to a diversified mix based on time horizon, risk tolerance and savings goals. The 60/40 portfolio mix is a tried and true portfolio allocation because it provides market gains during market rallies and fixed income reliability during economic slowdowns. This portfolio is most suitable when interest rates go down, as equities perform well. When interest rates rise, equity returns typically fall.

Tim Pierotti—Factor Investing Video Guide

In this video Tim discusses Factor Investing and goes over Quality, Momentum, Value, Size and Volatility Factors and how they function within an investment portfolio.

What Did We Learn This Week? (10/06/2022)—Sell-side Research

In this week’s essay, Tim discusses the problem of trying to value the equity markets based off consensus forward estimates. Wall Street estimates will always be behind the curve in a downturn and this time is no different. Stocks may look “cheap” on current estimates but those estimates are always far too high ahead of recessions.

WealthVest: The Weekly Bull and Bear S7E1: Russia Halts the Gas

In this episode Drew and Tim discuss how economists are divided on whether or not we are in a recession, fewer Americans living paycheck to paycheck, corporate profits and Russia turning off the gas.

Tim Pierotti and Drew Dokken: Oil Update June 2022

Tim and Drew go over the outlook of oil and gas markets. For more from Tim Pierotti, WealthVest's Chief Investment Strategist subscribe to our podcast WealthVest: The Weekly Bull and Bear at https://shows.acast.com/the-weekly-bull-and-bear or wherever you listen to your podcasts.

WealthVest: The Weekly Bull & Bear S6E12: Tim Pierotti Guest

In this episode of WealthVest: The Weekly Bull & Bear, Tim Pierotti comes back as a guest and discusses the GDP contraction, the job market, the Fed, fiscal policy and the prospect of stagflation.

WealthVest: The Weekly Bull & Bear S6E11: Louis G. Navellier, Navellier & Associates

In this episode of the Weekly Bull & Bear, Louis G. Navellier , Chairman and Founder of Navellier & Associates, joined Drew to discuss the global economic recovery, earnings season, the Fed attempt at lowering inflation, I-bonds, stagflation prospects, emerging markets and the Lifetime Income for Employees Act.

WealthVest: The Weekly Bull & Bear S6E10: Potential Russian Default

In this episode, Drew and Grant discuss concerns over inflation, the risk of stagflation, the potential of a Russian default and why U.S. exchanges didn't delist Russia

WealthVest: The Weekly Bull & Bear S6E9: Brainard's Comments

In this episode of WealthVest: The Weekly Bull & Bear, Drew and Grant discuss Lael Brainard's comments, the March job report, how households are adjusting to inflation, American concerns about a recession, the price of diesel, strategic oil reserves and the defense production act being invoked for EV battery materials.

WealthVest: The Weekly Bull & BearS6E8: WealthVest/ Janus Henderson March 2022

In this episode Matt Peron, Director of Research at Janus Henderson Investors, joined Drew and Grant to discuss the stock market for the rest of the year, the state of the economy, emerging market equities, oil prices, precious metals, inflation and whether or not younger investors will be more conservative.

WealthVest: The Weekly Bull and Bear S6E7: Fed Rate Hike

In this episode Drew and Grant discuss the Fed rate hike, the holdup in the nomination process, oil prices tumbling, suspending the gas tax as public policy, global recessionary risks, Russia nearing default and the effectiveness of sanctions.

WealthVest: The Weekly Bull and Bear S6E6: Russia and Ukraine at War

In this episode Drew and Grant discuss the Russian invasion of Ukraine, the response of the international community, stock performance in times of geo-political crisis and the aftermath, the global economic consequences of the war, Russia losing access to Swift, volatility-based commodity plays and REITS.

WealthVest: The Weekly Bull and Bear S6E5: WealthVest/ Drawing Capital February 2022

S6E5: WealthVest/Drawing Capital February 2022

Season 6, Ep. 5

In this episode of WealthVest: The Weekly Bull&Bear, Sean van der Wal and Sagar Joshi of Drawing Capital come back on the podcast.

Topics including: Tech stocks, major technological trends, the metaverse, corporations creating their own cryptocurrencies, automation and what it means for the future of work, and how the U.S. is lagging behind China in the race to 5-g are all covered.

WealthVest: The Weekly Bull and Bear S6E3: Solid Jobs Report and Meta Sell-Off

S6E3: Solid Jobs Report and Meta Sell-Off

Season 6, Ep. 3

In this episode of WealthVest: The Weekly Bull & Bear; Drew and Grant discuss Ark Invest, Amazon's earnings, the jobs report, Facebook's drop, the European Central Bank's interest rate policy and some of the newly proposed SEC regulations.

TECHNICALS VS FUNDAMENTALS

With the Covid-19’s stock market sell off in March, and subsequent rebound over the last few weeks, it is important to look at the metrics that might define the bottom of a market. Timing the bottom of a market correction is an exercise in futility, but it is important to understand some of the fundamental and technical metrics that can help investors contextualize the price of the market.

IS A 9% ANNUAL AVERAGE RETURN ENOUGH FOR YOUR CLIENTS IN RETIREMENT?

How do you demonstrate timing and sequence of returns risk with your clients? The consumer-facing sales tool “The Hatfields and Mccoys” tells a simple yet effective story on sequence of return risk. In the piece, we examine two hypothetical families entering retirement at age 65, but under different circumstances. Both families retire with $500,000 of their nest egg fully invested in the S&P 500® index. They both withdraw 4% annually, with a 2.5% increase each year to keep pace with inflation. The McCoys experience the annual returns from years 1978 to 2008, while the Hatfields experience the same returns, but in reverse chronological order, with a key point being that the annual return for 2008’occurs during their first year of retirement and the return for 1978 is their last.