Rethinking 60/40: Part 1-Why investors use 60/40 allocations?

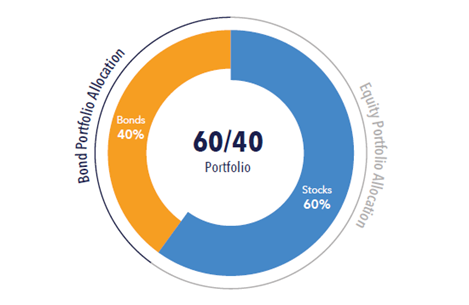

A 60/40 Portfolio Diagram

A portfolio invested in 60% stocks and 40% bonds, commonly known as a 60/40 portfolio, is where many portfolios start before adjusting to a diversified mix based on time horizon, risk tolerance and savings goals. The 60/40 portfolio mix is a tried and true portfolio allocation because it provides market gains during market rallies and fixed income reliability during economic slowdowns. This portfolio is most suitable when interest rates go down, as equities perform well. When interest rates rise, equity returns typically fall. However, during interest rate increases, bond funds and bond values in the secondary market fall putting the entire 60/40 at risk for loss. In our Rethinking 60/40 series, we will look at how today’s investors can protect against an environment of low bond returns, and market volatility.

One way that investors landed on a 60/40 allocation is by looking at the Efficient Frontier, a cornerstone of modern portfolio theory. It holds that a set of portfolio constructions will provide optimal performance for various levels of risk, as shown in the diagram below.

The Efficient Frontier Based on Age

/ Portfolios on the line are expected to deliver the highest return for a given level of risk.

/ Portfolios below the line are not efficient because they do not provide enough return.

/ Portfolios above the line are not efficient because they take on too much risk.

Generally, as an individual gets older, they look to reduce risk in their portfolio to avoid financial loss close to retirement among other factors. Many individuals may have more risk in their portfolio than they think. In the coming articles, we discuss how risky 60/40 allocations are, historical examples of 60/40 allocations, what we can learn from history, and what options exist for reallocating from 60/40 portfolios.

For more in our series: Rethinking 60/40, read our consumer-approved whitepaper https://www.wealthvest.com/rethinking-60-40-myga or find our newest posts at www.wealthvest.com/wealthvestblog

Are you interested in alternatives to 60/40 allocations? Contact us at 877-595-9325 or reach out to your wholesaler. Don’t know who your wholesaler is? Meet them by filling out the following form.