Rethinking 60/40 Part 2: What can we learn about the years when stocks and bonds are both negative?

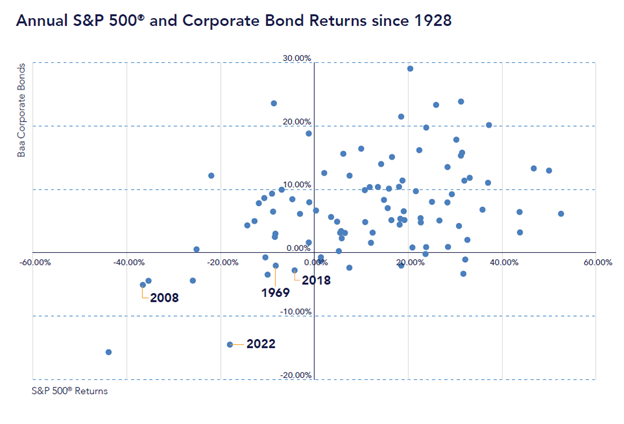

In our last blog post, I discussed the underlying reasons for today’s underperformance of 60/40 portfolios, but let’s look at how much of an anomaly today’s times are and where 2022 falls in history. Since 1928, we can glean the underlying reasons a 60/40 portfolio allocation became popular method for investors seeking reliable returns. The chart below shows historical corporate bond yield and the S&P 500® returns by year, demonstrating how often bonds and stocks remained positive. However, looking at the years in which equities and bonds are negative provides important context for the contemporary market environment.

NYU Stern School of Business, Monthly and Annual on Stock, T. Bonds and T.Bills: 1928 - Current https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html (Jan. 2023)

Diving deeper into the years when the S&P 500® was negative we see that during equity downturns, 60/40 portfolios averaged returns of -7.26%.

Returns of Stocks and Bonds During Negative S&P 500® Years since 1969

What can we learn from 1969?

In the mid-1960s, rising prices led the Fed to focus on combating inflation by rapidly raising the Fed funds rate, which eventually led to a recession and a period of negative returns for 60/40 portfolios. 1969 was a unique year in which bond values and stocks were negative, the 10-year treasury yield returned -10.56% and corporate bonds faired marginally better at -2.03%. Coming out of this recession, bonds eventually recovered but only after inflation was properly combated. Although bonds may be a suitable option when the economy is slowing, they are not when inflation is increasing. Because when stocks decline during inflationary periods, the Fed may raise interest rates to slow inflation.

In the years when the hypothetical 60/40 portfolio experienced negative returns, the MYGA would have delivered a fixed rate of return, insulating losses and protecting against sequence-of-return risk.

In over 73% of the years since 1928 60/40 investors have experienced gains. However, there is risk in the down years. In 2022, 60/40 portfolios faced one of their worst years since the 1930s, with a hypothetical 60/40 portfolio returning -16.60%. Sequence-of-return risk, or improper timing risk, can greatly impact retirement income plans. This is why you should insulate your retirement portfolio from 60/40 underperformance.

In our coming posts, learn more about alternatives to 60/40 portfolios. For more in our series: Rethinking 60/40: read our consumer-approved whitepaper https://www.wealthvest.com/rethinking-60-40-myga or find our newest posts at www.wealthvest.com/wealthvestblog

Are you interested in alternatives to 60/40 allocations? Contact us at 877-595-9325 or reach out to your wholesaler. Don’t know who your wholesaler is? Meet them by filling out the following form.